The federal government has merged the two previously announced measures – “The Emergency Care Benefit” and “Emergency Support Benefit” into the new Canada Emergency Response Benefit (CERB), to provide financial relief to workers who have ceased work for reasons relating to COVID-19.

As outlined in Bill C-13, the following FAQ will provide information about the benefits, eligibility rules and payment schedules:

What is the Canada Emergency Response Benefit?

The Canada Emergency Response Benefit is a temporary income support that will provide up to $500 a week for up to 16 weeks. The support will be provided to workers who have been out of work for 14 consecutive days in any (4) four-week period due to reasons relating to COVID-19.

Under what circumstances can you apply for the Canada Emergency Response Benefit?

The Canada Emergency Response Benefit covers workers who have ceased working for 14 consecutive days for reasons related to COVID-19:

- Have been let go from your job or your hours have been reduced to zero;

- Still employed but not receiving any income due to Covid-19;

- Are sick, quarantined, in self-isolation or taking care of someone who is sick with COVID-19; or

- Are working parents who must stay home without pay to care for children due to illness or school/daycare closures;

- Are self employed and would not otherwise qualify for Employment Insurance (EI);

- Are a contractor and would not otherwise qualify for Employment Insurance (EI).

Please note you cannot quit your job voluntarily to qualify for CERB.

Who does the Canada Emergency Response Benefits apply to?

- Wage Earners;

- Contract workers;

- Self-Employed individuals

What are the eligibility criteria?

- Must be a resident of Canada;

- Must be 15 years or older;

- Have had a total income of at least $5,000 (combined) in 2019 or in the 12 months immediately preceding the application form

- Workers who are or expect to be without employment or self-employment income for at least 14 consecutive days in the initial four-week period. For subsequent benefit periods, they expect to have no employment or self-employment income

- You are not receiving nor have you applied for the Employment Insurance (EI) benefits for the same benefit period

Note: Any other EI benefits received cannot be accounted towards the $5,000 threshold.

The Government of Canada announced that will expand the CERB program to include workers earning up to $1,000 per month.

When submitting your first claim, you cannot have earned more than $1,000 in employment and/or self-employment income for 14 or more consecutive days within the four-week benefit period of your claim. When submitting subsequent claims, you cannot have earned more than $1,000 in employment and/or self-employment income for the entire four-week benefit period of your new claim.

Alternatively, you can apply for the Canada Emergency Response Benefit if:

- You are eligible for Employment Insurance regular or sickness benefits; or

- You received Employment Insurance regular benefits between December 29, 2019 and October 3, 2020 and have exhausted all of your available entitlements, or exceeded the period in which you could continue to collect these benefits.

What is counted towards the $1,000 of income?

- Employment or Self-Employment Income

- Tips, declared as income

- Non-eligible dividends

- Honoraria (i.e nominal amounts paid to emergency service volunteers)

- Royalties

Pension income, student loans and bursaries are not considered employment income and should not be included.

Am I eligible for the CERB if my working hours have been reduced and I am receiving a small portion of income?

The Government of Canada has announced it will expand the CERB to include workers earning up to $1,000 per month. See information above.

If I am in receipt of dividends am I eligible for the Canada Emergency Response Benefit?

Yes, as far as those dividends are paid out as non-eligible dividends (generally, those paid out of corporate income taxed at the small business rate). An individual could count this income towards the $5,000 income requirement to be eligible for the CERB.

It is important to remember that a claimant must also have ceased work due to COVID-19. If the business is still running, and the individual is still active in it, they are not eligible for the CERB.

What if you’ve determined that you are ineligible for the CERB, but already received the funds?

If the CRA determines that an individual received a CERB payment to which the person is not entitled or an amount in excess of the amount of such a payment to which the person is entitled, the person must repay the amount of payment received as soon as it is feasible.

Is the Canada Emergency Response Benefit taxable?

At this point, it has been announced that the CERB is a taxable benefit, although tax will not be deducted at the source, until further notice.

How much will you receive through the Canada Emergency Response Benefit?

The benefit will pay out $2,000 in blocks for four weeks, to a maximum of 16 weeks.

Is the income threshold of $1,000 pre-tax income?

Yes, the government website states that the individuals should consider their pre-tax income to qualify for the Canada Emergency Response Benefits (CERB).

- Individuals who receive a salary should consider their pre-tax salary

- Individuals who rely on self-employed business income should consider their net pre-tax income (gross income less expenses)

- Individuals who rely on dividend income should consider dividend income that comes from non–eligible dividends (generally, those paid out of corporate income taxed at the small business rate)

Can you apply for the CERB if you are not a citizen or permanent resident?

Yes, if you meet the eligibility requirements, which includes residing in Canada having a valid SIN number.

Are you eligible if you have not declared that you have earned any income in the last year?

In order to qualify, you will need to attest that you had at least $5,000 in employment or self-employment income in 2019, or in the 12 months prior to the date of your application. You will also need to confirm that you have not earned more than $1,000 in employment and/or self-employment income in a period of at least 14 consecutive days within the first benefit period and for the entire four-week benefit period of any subsequent claim. If you are deemed ineligible for the benefit at a later date, you will be required to pay it back.

Are you eligible if you are a seasonal worker who has exhausted your EI?

Yes. You are eligible for the Canada Emergency Response Benefit (CERB) if you are a former Employment Insurance claimant who used up your entitlement to your Employment Insurance regular benefits between December 29, 2019 and October 3, 2020, and are unable to find work due to COVID-19.

The date for which you would potentially become eligible for the Canada Emergency Response Benefit would be the week following your last Employment Insurance benefit payment or March 15, 2020, whichever is most recent. You may not receive EI benefits and the Canada Emergency Response Benefit for the same period.

Are you eligible if your employer entered into a work-sharing agreement?

No, individuals who are part of work-sharing agreements with their employer are not eligible to apply for CERB as you cannot be receiving Employment Insurance Benefits and the Canada Emergency Response Benefit at the same time. The Canada Emergency Response Benefit has no impact on claims subject to work-sharing agreements. These claims continue to be processed using the standard rules for calculating work-sharing benefits.

Are you eligible if you are a student working part-time jobs and have lost income due to reasons related to COVID-19?

Yes, students who have lost their job as a result of reasons related to COVID-19 and who meet the other eligibility criteria are able to apply. However, the government has confirmed that student loans and bursaries do not count toward the $5,000 in income eligibility requirements.

The government is working on a new program, the Canada Emergency Students Benefits (CESB), for post-secondary students who don’t qualify for CERB at the moment.

Can you apply for EI and the CERB?

Currently, you can only apply for either EI or CERB. If you have already applied for EI, you do not need to apply for this new benefit. At this point, you cannot be paid EI and the CERB for the same period.

If you were eligible for Employment Insurance Benefits before March 15, 2020, and these benefits end before October 3, 2020, you may then apply for the Canada Emergency Response Benefit if you meet the eligibility requirements, including that you have stopped work because of reasons related to COVID-19.

Should I apply for EI or the CERB?

As it stands, it is most advantageous for EI eligible workers to apply directly for Employment Insurance. Applying for EI will better assist workers, particularly those who expect to continue receiving EI benefits after the initial 16-week period has expired.

However, to streamline the process due to an exponential number of EI claims, the federal government has established a new, interim Employment Insurance Emergency Response Benefit to mirror the benefits provided in the CERB. Over the coming months, benefit payments will be comparable (equivalent to $500 per week), although payment schedules and other measures will remain distinct.

It is also important to note that the government is automatically processing all EI regular benefits and sickness benefits claims from March 15, 2020 or later through the CERB in order to get income into the hands of Canadians more quickly, as the EI system currently has a backlog of claims. This means that for the first 16 weeks you will receive the CERB payments of $500 per week, (paid in blocks of 4 weeks), and then you will be able to access EI regular or sickness benefits if you are still unemployed or sick when you stop receiving the CERB.

If you became eligible for EI prior to March 15th, your claim will be processed under the pre-existing Employment Insurance rules. If you are already receiving Employment Insurance regular benefits, you will continue to receive these benefits until the end of your benefit period. You cannot exit the Employment Insurance system to apply for the Canada Emergency Response Benefit before the end of your Employment Insurance benefit period. You also cannot receive Employment Insurance benefits and the Canada Emergency Response Benefit for the same period.

If a worker is not eligible for EI, the only option available to them is to apply directly to the Canada Emergency Response Benefit.

What if I don’t meet the eligibility for Employment Insurance or the Canada Emergency Response Benefit?

The government has indicated that they recognize not all workers a self-employed individual will qualify for either program. They are continuously working to address those cracks and situations and will propose more relief measures in the coming weeks.

Am I eligible for the CERB if I am on special benefits such as maternity/parental benefits?

You cannot receive maternity or parental benefits at the same time as the CERB.

It is expected that you will return to work when you are finished collecting maternity/parental or other special benefits under the Employment Insurance Program. If you are ready to return to work when you finish collecting maternity/parental or other special benefits, but work is not available as a result of reasons related to COVID-19, you may be eligible to apply for the Canada Emergency Response Benefit.

Where can you apply for the Canada Emergency Response Benefit?

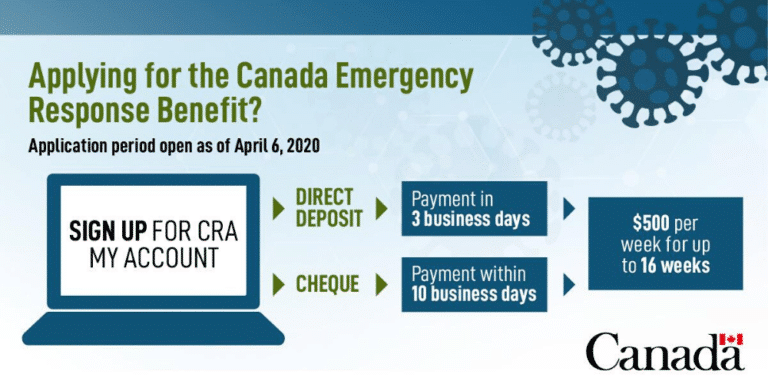

The application process is open as of Monday, April 6, 2020. Applications will be processed within 10 days from when an application form is submitted. Applications can be back-dated to March 15, 2020.

There are two ways to apply:

- Online

- Over the phone with an automated phone service: 1-800-959-2019 or 1-800-959-2041

Both of these services are available 21 hours a day, 7 days a week. Both services are closed from 3:00 a.m. to 6:00 a.m. (Eastern time) for maintenance.

Canada Revenue Agency has announced that they have partnered with many Canadian financial institutions to offer CRA direct deposit enrollment online, through their financial institutions website.

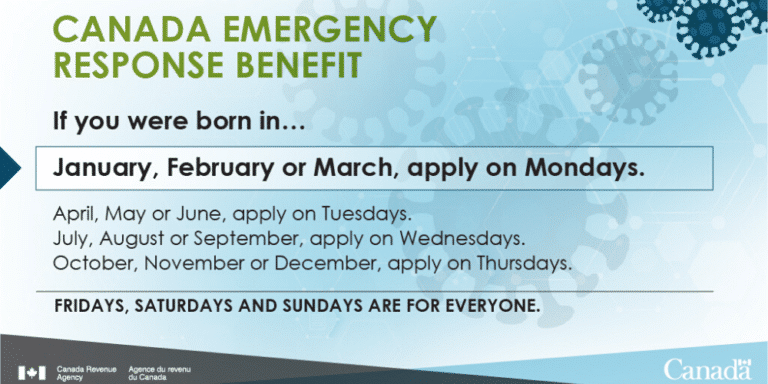

The Government of Canada and the CRA are asking for applications as follows:

What documents do I need to submit?

You do not need extensive documentation immediately to apply for the CERB. You will need to provide:

- Your personal contact information

- Your Social Insurance Number

- You’ll need to confirm you meet the eligibility requirements

You could be asked to provide additional documentation to verify your eligibility at a future date.

Once you receive your first payment, will the renewal of payments be automatic?

No, the renewal of payments will not be automatic. You must confirm your eligibility for each period for which you apply either online via my CRA my account or by phone (1-833-966-2099).

If you are receiving your benefit through Service Canada you must complete your Employment Insurance Report Card to confirm your eligibility. The eligibility periods are fixed in 4-week blocks. You can apply for multiple 4-week periods, to a maximum of 16 weeks (4 periods).

If payments are made in error or incorrectly, you will be expected to process the repayment. Information on repayments can be found here.

Find more information on the Canada Emergency Response Benefit here.

Disclaimer: “The preceding information is for educational purposes only. As it is impossible to include all situations, circumstances and exceptions in a newsletter such as this, a further review should be done by a qualified professional. No individual or organization involved in either the preparation or distribution of this letter accepts any contractual, tortious, or any other form of liability for its contents or for any consequences arising from its use”.